Is the Stock Market Going to Crash in 2022?

February 23, 2022 2022-02-23 19:26Is the Stock Market Going to Crash in 2022?

Is the Stock Market Going to Crash in 2022?

Wow, what a bold statement that is for a headline! Well first thing to keep in mind is not to panic right away. This article is not financial advice for you to buy or sell investments. Always consult with a register financial advisor. We are not a registered financial advisor. This article is here to educate you on the potential economic factors that we see in 2022.

Let’s first start off explaining what has happened since January 2022:

When we measure the performance of the US equity indices since the start of January 2022 till February 2022, we see the following:

- S&P 500 dropped about 12% from January highs.

- NASDAQ dropped about 18% from January highs.

- Russell 2000 dropped about 17% from January highs.

- Dow Jones dropped about 10% from January highs.

The reason the US equity indices sold off is because the market is trying to understand what the US Federal Reserve (Fed) is going to do in the coming months. The Fed has already mentioned that they are planning to raise interest rates in March and are planning towards moving into a quantitative tightening cycle. Not only are interest rates expected to rise, but a balance sheet run off is also expected to start sometime this year.

Now what does that mean for the year 2022? Will the markets continue to fall?

Here are some of the risks we see in 2022 to answer that question:

An overly hawkish Fed

If the federal reserve is MORE hawkish than the market is pricing in, then yes, it is possible that the stock market may not like that. Currently the analysts at the big banks are projecting that the Fed will raise rates 7 times in 2022 and 2 times in 2023. There is also an expectation that the Fed will sell about $100-$125 billion in treasuries each month as part of their quantitative tightening program.

Now, it seems like markets are overly hawkish already on the Fed and the reason is because they feel the Fed will try to attack inflation aggressively through their monetary policy measures. However, it is possible that we could see a less hawkish Fed than what the markets are pricing in, which can cause a relief rally in the stock market. But we will need to wait until March to hear more details about the Fed’s plan on their quantitative tightening program.

Therefore, all eyes on the Fed for the March 2022 meeting! This could dictate where the stock market may want to go.

March Fed Meeting 2022

This meeting will be one of the most important economic meetings as we could hear more about the plans for the Fed about its quantitative tightening program.

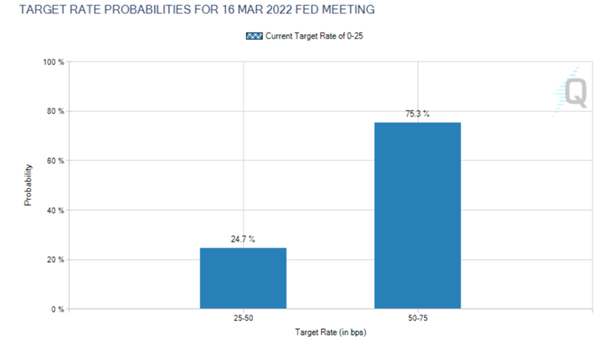

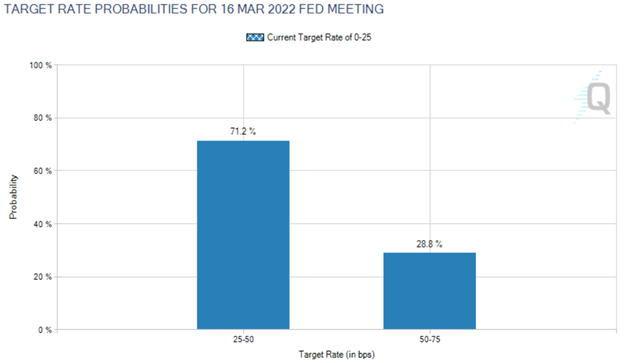

When we look at the stock market, traders seem like they are thirsty for more information. There is a lot of confusion among traders, when deciding whether the Fed will raise rates once (25 bps) or twice (50 bps) in the upcoming March meeting. We can see that from the CME fed watch tool:

On February 10th after a very strong inflation number, which shocked the markets and caused a sell off. The CME fed watch tool showed that markets were pricing in a 75% chance of TWO rate hikes in March:

However, this changed very quickly after a week later when a few Fed members came out and said they would not favor a 50-bps rate hike. Once this happened the probabilities of TWO rate hikes in March have now fallen to 28%:

Again, a lot is at stake with this March meeting and if we end up getting a 50-bps point rate hike in March, it could cause another sell off in the stock market. Therefore, we will wait for March to hear more details from the Fed.

Overshoot in Inflation

Inflation has been on everybody’s mind as prices of goods and services continue to rise. When we look at the US Core CPI YoY we are seeing inflation is rapidly rising to levels we haven’t seen since the 1980s!

The Fed has expressed that inflation is one of the metric that they are worried about for 2022. They don’t want to see inflation overshoot, hence that is why they are planning to begin their quantitiative tightening program this year. The Fed projects that inflation will eventually subside as we get closer to the end of 2022. However, the Fed has been wrong before about inflation when the committee thought that inflation was “transitory” in 2021. Therefore, inflation is one of the metrics that we will need to watch in determing whether stocks will continue to fall or not. Thus, these are the following questions I will monitor and find answers to as I get more information from the market:

- Is inflation continuing to rise each month? If yes, at what rate is inflation rising? Will this rise bring fears in the stock market again?

- Is the Fed’s plan of quantitative tightening lowering inflation?

- If not, will they become more aggressive in their tightening?

- If the Fed is more aggressive, what more will they do and how will the stock market react?

These are all questions that we will answer in the www.inforvesting.com private community chatroom, as we gather more details about the economy.

Supply constraints and Labor Shortages

With Covid-19 and the rise of the new variants, this continues to create problems with the labor market and the supply chain in many economies. The restrictions that have been imposed by the government and the fear of the virus has caused massive bottlenecks in the supply of many commodities, goods, services, and the housing market. If supply continues to be a problem, then we can see that feed into the prices, which will cause inflation to rise. And I don’t think the Fed can do anything about that, unless maybe they get MORE aggressive with their monetary policies. However, the supply chain shortages will improve if the government loosens the restrictions more and the virus fades away.

The same goes for the labor shortages. People who are not going back to the workforce due to fears of Covid, is another contributing factor to inflation as companies are seeking for employees and enticing the labor force with higher wages. As one company increases their wages, the same will happen with all other corporations to be competitive in the market. And wages tend to be “sticky”, which means it has long lasting effects on inflation.

Overall, if supply constraints and labor shortages can improve, then it will help with the narrative that inflation will soon fall lower as the world goes back to normal.

Weak Economic Growth

Another factor to watch out for is economic growth. If economic growth in an economy starts to deteriorate in a tightening cycle and a high inflationary environment. It is going to cause future earnings for corporations to fall, which can feed into potential layoffs in the labor market, which could cause another panic sell off in the markets.

If growth in the economy can continue to be strong as inflation decreases and rates rise, then this would be very healthy for the stock market, which can cause a relief rally back to new highs for the year. But we will have to monitor this month by month as we get more information.

The Technicals

Last, but not least, I want to share a technical formation with you on the S&P 500. There is a head and shoulders formation on the daily chart that looks like this:

This technical formation is a bearish formation, which signals that the S&P 500 could fall to $3,800 if things get worse. That would be an additional 10% drop from current levels and 20% drop from January highs.

However, at Inforvest, we are not pure technical traders. We also include fundamental analysis in our trading. So, we need both the fundamental and the technical analysis to agree with each other before calling any kind of additional sell off.

But we will continue to monitor this technical formation, and we will continue to monitor the fundamentals before we can start calling the stock market sell off.

We teach a lot of these concepts on understanding fundamentals and technicals in our 3-Month Trading Program. Our classes are running every month and we help turn novice traders into smart knowledgeable traders. If you are interested in learning more about the program feel free to reach out to us at [email protected] or simply visit our website at www.inforvesting.com or the programs page at https://inforvesting.com/courses/3-months-trading/. If you are interested in joining our free webinars, please send us an email as well.

Conclusion

Overall, 2022 has been a rocky start to the year. A lot can happen in the coming months with inflation, data, and the Fed. Will the stock market crash in 2022? That is something that we will need to analyze in the coming weeks as we get more information. For sure, there are some risks that could cause some additional selling, but we can’t say 100% until we get more information.

Wishing you all the best in 2022! And Happy Trading!