Peloton Stock Crashes More Than 80%

January 21, 2022 2022-01-21 14:19Peloton Stock Crashes More Than 80%

Peloton Stock Crashes More Than 80%

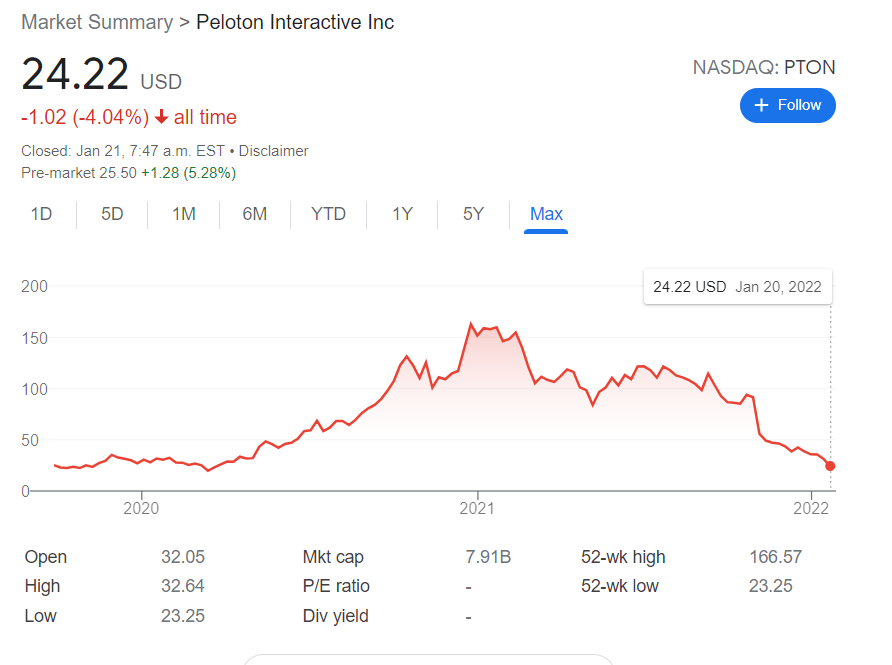

If you don’t know what Peloton is, it’s a company that sells an at-home cycling bike which is connected to an online streaming service. Peloton began trading on the NYSE in November 2018. Its market cap reached $8 billion with its share price reaching $170 as investors were eager to get involved with the latest darlings of the fitness world. Since January 2021, Peloton has fallen more than 80% from its peak. Peloton is now sitting around $24.22 a share, which are levels seen back in 2019. But what has happened to Peloton? Why has it been crashing?

The reason for the Peloton stock crash is simple:

Its business model isn’t profitable.

Peloton’s losses are growing rapidly and it’s burning through cash at an alarming rate. Peloton makes money when you buy the bike and purchase a subscription to the streaming service. In theory, once you start riding regularly, you’ll need to buy new shoes and clothes. And since cycling is a low-impact exercise, any injuries are unlikely, meaning you won’t have to purchase other equipment like weights or yoga mats. In practice, Peloton customers don’t appear to be buying new clothes or shoes with any regularity. According to SEC filings, Peloton lost $34 million in 2016, $47 million in 2017 and $70 million in 2018. That’s a total of $151 million in losses over three years from just one product line! The company is raising plenty of money by selling shares but it turns out that simply printing money isn’t enough to stay

Peloton is a Covid stock.

What that basically means is the reason Peloton did so well during Covid, the stock went up more than 600% since March 2020, is simply because the lockdowns of gyms and many places created a craze for people to workout at home via the Peloton machines. However, now that gyms have been opening up, the desire to go back to the gym and socialize and interact with others have increased, which puts Pelotons business model at risk.

Peloton reminds of the Bowflex or the P90X CDs that had a massive craze in the start and all of a sudden died out. And it seems like the same history is repeating with Peloton. Everyone got interested in this new gadget during the lockdowns and then once the gyms and businesses started to open up, people started to forget about their fancy gym equipment that they bought during the lockdowns.

Peloton November 2021 Earnings and 2022 Production Halts

On November 4, 2021, Peloton posted grim earnings as sales weaken and the growth outlook softened. This caused a more than 25% drop once the earnings came out. The CEO also mentioned that they see slower growth and challenges for the upcoming quarters.

Fast forward to January 20, 2022, Peloton came out again and mentioned they are halting production as consumer demand continues to weaken and the company needs to manage the costs. This caused Peloton to drop another 23% to a share price of $24.22, which was a price last seen in 2019.

So, do you want to get involved with the Peloton stock crash? I’d say only if you’re willing to take a chance on a company that could be the next big thing. That said, if you already own Peloton stock and it’s fallen in value, you might be either selling now for a loss or holding onto your shares and waiting to see what happens. In my humble opinion, I don’t see Peloton being the next “big” thing. To me, it seems like another Bowflex or P90X that had its hype and then eventually it died out. Good luck, and happy investing!